We recently received this letter from an astute observer of the industry:

We read your report on Fresh & Easy’s results for the first half of their 09/10 FY. Since you are the foremost leading authority on Tesco in the US, we were hoping you might have sales numbers for the first 5 months they were operating, Nov ‘07-Mar ’08.

I see that J.P. Morgan didn’t have an estimate for that period and all the reports we have on file also say that the first time they reported sales was at the end of the 1st half of their FY for 08/09, after they had been operating for 10 months.

We feel there has to be some actual 07/08 numbers floating around somewhere though!

Any information you have would be much appreciated!

Thanks.

— Lisa Reeder

Innovation Research Analyst

H-E-B/Central Market

Austin TX

Well, flattery gets one everywhere, so we will do our best to answer Lisa’s question. Yes, in fact, despite promises to The City in London, the UK’s version of Wall Street, Tesco hid the early results from Fresh & Easy by rolling them into the British numbers. We poked a little fun at this decision in a piece we titled Memo To Sir Terry Leahy: King George II Lost The War; America Is Independent Now, in which we quoted a report authored by James Anstead, then heading up the Citi European Food Retail Team and now doing a bang-up job at Barclays Capital. Here is the heart of the piece:

As if our substantial reporting on Tesco’s launch of its Fresh & Easy concept was not sufficient evidence that things were not all coming up roses, prior to Tesco’s announcement of a “pause” we received word from London that Tesco is likely to attempt to hide the results of its new US venture within the results of its massive UK retail operation. In fact, Tesco has already done so surreptitiously in previous reports.

James receives the credit for catching this subterfuge, which shows he is both smart and minding his knitting.

He is also rather brave.

We learned this when he arranged for the Pundit to present a conference call about Fresh & Easy to investors looking to the Citi team to inform their investment decisions.

Many analysts tremor at letting a negative word pass their lips — because they fear losing access to important companies. Although he acted as Tesco’s advocate in our conference call — and a fierce and effective one at that — James still felt it important to allow Citi’s investors to hear other perspectives.

Now James Anstead has authored a report that made several salient observations:

1. The expectation has been that Tesco would report separate numbers for its USA business:

Until recently, we were under the impression that Tesco would create a fourth ‘reporting segment’ (in addition to UK, Europe and Asia) as soon as the first Fresh & Easy store opened. There were two reasons for us holding this belief:

• We remember Tesco telling us this — and the fact that other parties also remember being told this suggests that our memories are not faulty.

• The consensus sheet that Tesco regularly circulates presents the US as a fourth segment.

2. But now Tesco is hemming and hawing on this point:

It was therefore something of a surprise when, in our conversations with the company, Tesco would not confirm that it would separately report the US business as of 2H07/08. The company was non-committal about how it will report the results of the US business on 15 April, when it is due to release its FY07/08 results. However, we took the fact that Tesco would not confirm its intentions — in an area we had understood to be very clear — as a sign that the results of the US business will not be separately identifiable on 15 April.

3. In fact, Tesco has — without bringing this to anyone’s attention — been hiding Fresh & Easy results in its massive United Kingdom business:

If the US is not reported separately, then the obvious place would be within the UK. (Incidentally this is not unprecedented — Tesco’s one French store is disclosed within the UK, but that is one store in Calais catering to ‘boozecruisers’, not a potentially large part of the group!) We decided to double-check where the US was reported over Christmas and were surprised to hear that F&E’s sales were effectively disclosed within the UK over the six weeks of Christmas trading, within the contribution from net new stores. (It was also disclosed this way in 3Q apparently, although there were hardly any F&E stores open in that period.)

4. Size of business would not justify this plan:

The fact that F&E was disclosed within the UK over the Christmas period strongly suggests that this will be the case for the FY results also. Normally Tesco provides sales details for every country at the 1H and FY stage in its ‘broker pack’. Not only would we expect the US business to remain within the UK on the face of the P&L on 15 April, but we would not be surprised to see it absent from the ‘broker pack’ analysis. This cannot be justified on grounds of size, considering even small countries in the past have at least had their sales featured in the broker pack — eg £4m of sales in Malaysia in 1H02/03.

5. Neither would commercial confidentiality:

Given that this is a 180-degree turn from what Tesco had previously suggested, it would not be surprising for the cynics to use this as evidence that management is disappointed by the early results. Commercial confidentiality does not work as a justification because this consideration would have been obvious to management when they gave the original guidance.

6. Conveniently, including Fresh & Easy numbers, even though small, in the UK numbers would have provided Tesco’s numbers a boost:

The inclusion of F&E within the UK figures must have — very slightly — inflated the contribution from net new space; we tentatively estimate by 5-10bps. Although this is clearly not a huge number by any means, it would have boosted a line that had been showing slight signs of weakness earlier in the financial year.

7. The market may react to a lack of candor on Tesco’s part:

We would argue that the decision to account for the US within the UK over the Christmas period was somewhat disingenuous. We would have expected the company to be quite candid on this topic given its treatment was not what most people would have expected. Indeed, looking back at the trading statement, the company’s comments about the US were made within the international section, not the UK.

And the money quote:

…if Tesco does indeed delay breaking out the US business, it will intensify the perception that F&E has not had an especially auspicious beginning. It will also do nothing for Tesco’s reputation for openness, which is unfortunate. No doubt Tesco will be able to point to other companies that have ‘hidden’ start-up businesses for some time, but the point is that their position seems to have changed since this time last year and the only explanation in our minds is that Tesco is disappointed with the sales figures achieved so far.

Now Tesco’s most recent report emphasizes that where things are reported has no effect on the actual performance of the business and that, long term, if the business is a success, nobody will remember this issue in five years’ time.

The report also emphasizes that Tesco is not attempting to speculate on the actual operating performance of Fresh & Easy but only on how such performance as might occur will be reported.

So, the answer to Lisa’s question is no, there are no official numbers because Tesco tried to bury them in its UK division.

However, Tesco did release a graph and some information from which clear deductions can be made. We pointed this out in a piece titled, Tesco Puts Positive Spin On Fresh & Easy Numbers:

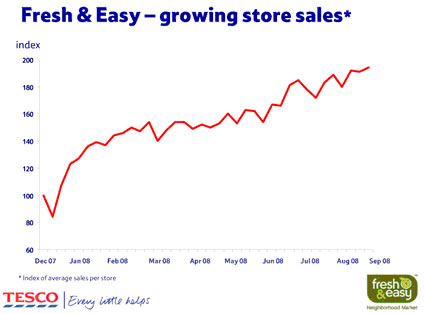

One thing that did come out from the report is that Tesco owes a lot of people, including the Pundit, an apology. Here is the graph Tesco distributed to show how Fresh & Easy is improving on its sales numbers:

The chart doesn’t reveal much, but since Tesco tells us elsewhere that the stores are averaging $11 per square foot, per week, and the chart shows that average sales per store have more than doubled back from their low point when we were doing our estimates — as were others such as Willard Bishop — then Willard Bishop, ourselves and others who were estimating about $5 per square foot, per store, per week were exactly correct and Tesco’s dismissive attitude was just a smokescreen.

So, though the exact figures aren’t public, from this graph we can deduce sales per store at each point in time and by multiplying the sales per store by the number of stores open at that time — 74 stores open as of August 23, 2008 for example — we can estimate fairly accurate numbers even for these early, undisclosed periods.

In any case, the Financial Times is running a piece, Tesco to Grapple with plans to Expand, that quotes Michael Dennis, an analyst with MF Global, saying that Tesco has so far invested $1.4 billion in the US operation and has had operating losses in the $650 million range:

In November 2007, the group invaded the US grocery market — a venture on which Sir Terry Leahy, chief executive, has staked his reputation. But the Tesco juggernaut has been met with the full force of the global economic downturn, which has hit California, Tesco’s launch market, particularly hard.

Tesco has 125 Fresh & Easy stores in southern California, far short of the 500 it had hoped for by February 2010.

Laurie McIlwee, finance director, said recently that there were signs of improvement at Fresh & Easy after the business was relaunched, with sales rising 37.4 per cent in the third quarter, and also stronger like-for-like sales.

Consequently, Tesco expects the business to make a loss over the full year close to its $259m (£160m) deficit of last year.

According to Michael Dennis, analyst at MF Global, Tesco has invested about $1.4bn in Fresh & Easy. He forecasts that it will have lost about $650m between its launch and February 2010.

Tesco has also put an expansion into northern California on hold but has continued to acquire sites in central to northern California. It is opening four stores in the Fresno area, its most northerly location to date.

Lucy Neville-Rolfe, corporate and legal affairs director at Tesco, says the retailer will move further north when it makes sense to do so.

“We did not expect to have the greatest recession since the 1930s. What we have got to do is do the right thing,” she says.

As we pointed out here, this claim that Tesco’s problem in the US has something to do with the recession is a lot of hooey. The recession actually gives a well capitalized company such as Tesco an opportunity to shine. If the company had a concept that made money, it would be utilizing this moment when real estate and labor are available to expand across the country. In fact, if all these stores were providing superlative returns on capital, Tesco would be looking to open them, well, in Texas, which is why sharp analysts like Lisa Reeder at forward-thinking companies such as HEB are smart to keep their eyes on Tesco.

Since we have written so much on Tesco’s Fresh & Easy, we sometimes have gotten questions about why it was important. Lisa’s letter is evidence for the basic proposition of the Pundit… to look for things that may be important in the future even if they seem insignificant now.

We thank Lisa for raising a question that points out that the sharpest companies don’t wait until a threat is in their neighborhood to understand it. In making that point publicly, Lisa and HEB provide a real service to the industry. Many thanks.